Nevertheless AAOIFI (2010) Shari’ah Standards believe that: “It is permitted into the organization which gives away financings to help you impose charges to the features made – a charge showing the degree of real sustained pricing, and is blocked of these organizations in order to costs a lot more as all of the extra up and above the cost of real costs are unlawful”.

So it takes place in the event the recipient doesn’t see particular preparations so you’re able to pay off the mortgage to your lender, standard of financing could potentially cause diminished adequate funds and therefore a few of people does not granted the borrowed funds

Ergo, it’s enabled to possess HELB so you’re able to charge financing which have administrative percentage towards the financing money to repay actual administrative expenses associated with new loan. That it is different from interest in the administrative payment is the actual expenses sustained of the HELB, while attention was commission to the use of the mortgage investment.

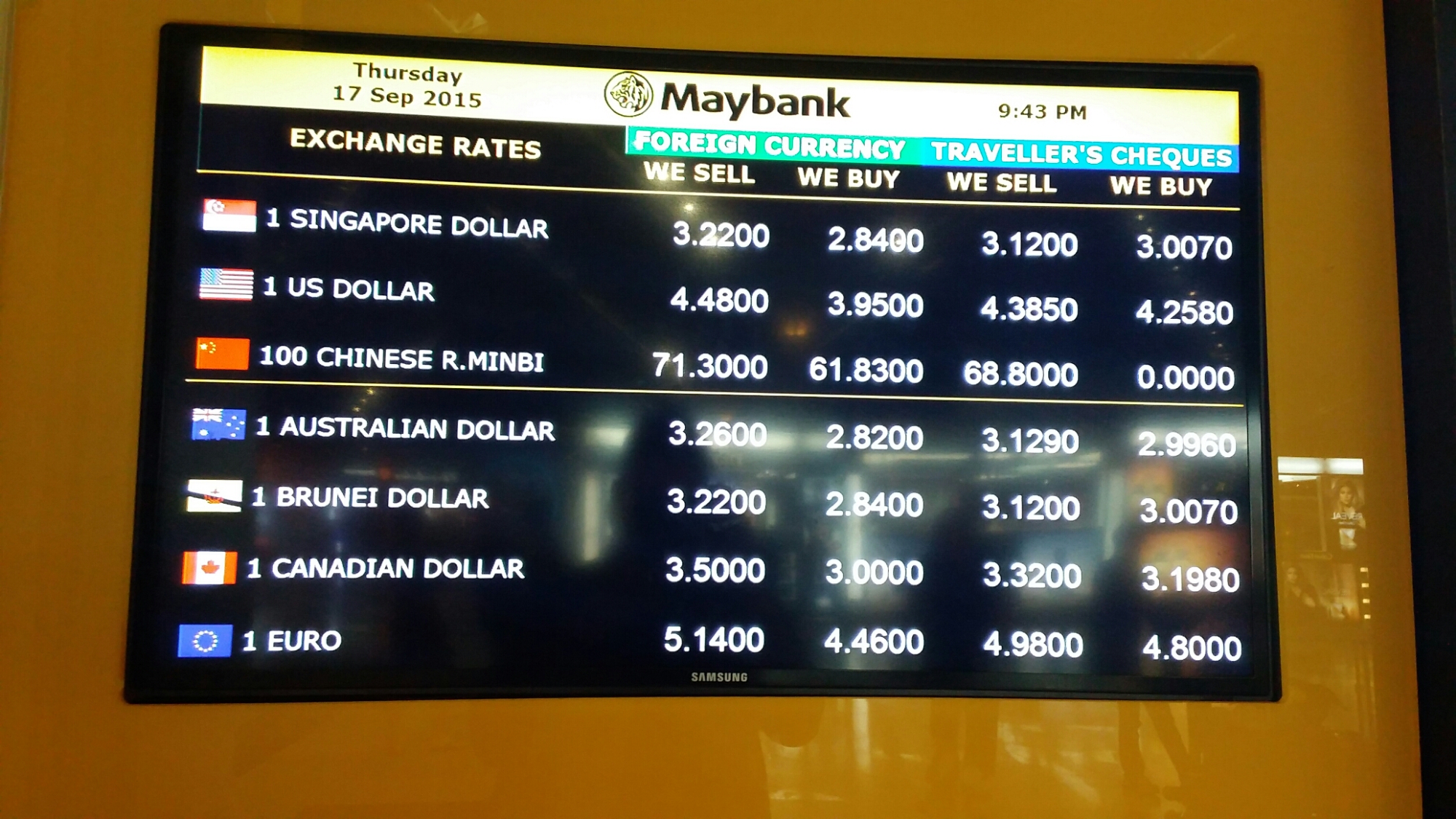

Higher education Loan Panel subsidizes the true fee of interest speed with the finance beneficiary, the rate faced with degree financing panel is lower compared to financial institutions. The next desk suggests desire recharged per year (HELB Handbook 2018: 4).

Of shariah perspective riba are identified as “the borrowed funds given to possess a selected months as long as on the the fresh new expiration of your months, the latest borrower usually pay it off that have excesses” (al-Jassas 1347: 451-465)

0% or cuatro.0 % which is not permitted into the Islamic laws towards borrower so you’re able to bring introduction come back to the lender for the reason that it would-be felt as the riba, for the Arabic words describes improve (Ibn Manzur 1986: 304-307). You will find much textual evidence regarding Quran and you may Sunnah and this prohibits trading for the focus. Allah said: “The new usury (interest) that is skilled to improve some people’s riches, doesn’t gain many techniques from Goodness. But if you share with foundation, trying to God’s satisfaction, these are the of them who receive the reward of many fold.” (al-Quran ).

Out-of Sunnah, it is narrated by Ibn Mas’ud, (Roentgen.A) “The brand new Prophet cursed the fresh recipient and also the payer interesting, the person who suggestions they while the two witnesses” (Ahmad container Hanbal ). Muhammad Abu Zuhra (1986: 24) contributes one: “One predetermined percentage across the above real level of dominant contribution is prohibited from inside the Islam”. Riba are blocked since the its unfair i.age. HELB requires introduction amount to the young and this will stop shortly after graduation instead of getting business options. Brand new Quran produces a definite research one to debtor are going to be treated effortlessly and never harder. Allah said, “If your borrower is during problems, grant your time right until it is easy having your to repay. However, if ye remit it through foundation, that’s effectively for you in the event that ye simply realized” (al-Quran dos: 280] It verse provides a advice in promoting brotherhood and you may welfare on the community, with regards to the verse of several beliefs is knew and promoted like the costs from tolerance, understanding each other and sympathy. This verse in addition to will teach all  of us not to ever end up being also enthusiastic about the brand new get together out-of wide range. In reality, it reminds united states the life of the day of Wisdom and you will thus just what is to matter very within our life is the newest buildup away from Allah’s pleasure.

of us not to ever end up being also enthusiastic about the brand new get together out-of wide range. In reality, it reminds united states the life of the day of Wisdom and you will thus just what is to matter very within our life is the newest buildup away from Allah’s pleasure.

A default takes place in two suggests in the event that debtor cannot result in the called for payment otherwise cannot follow laws and regulations and controls out-of financing (Al-Tamimi & Al-Mazrooei 2007: 394-396). Inability to settle extent repaired by HELB will punish away from the least KSh 5, that is recharged every month if a person will continue to standard the payment (Laws off Kenya 1995: 11). On top of that Advanced schooling Mortgage Board cooperates that have Borrowing from the bank Reference Agency (An organization that is qualified because of the Central Lender out-of Kenya to collect and you may spread credit guidance to reduce the borrowed funds standard risk) as well as the default on financing is blacklisted from the Bureau (Tuko Ideal Digital Reports Platform 2020: 1), from securing unsecured loan, automobile plus bank card institution. But if a default took place commission, this isn’t enabled any penalty becoming fees from inside the Islamic law, only real loan otherwise debt collection are enforced. The reason behind ban of such charges is they slide below demand for Islamic jurisprudence. Allah told you: “Whether your borrower is actually problems, grant him date Right up until it isn’t difficult for him to settle. However if ye remit it because of charity, that is best for you in the event that ye only knew” (al-Quran dos: 280).